Renters Insurance in and around Bedford

Renters of Bedford, State Farm can cover you

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

It may feel like a lot to think through work, family events, your busy schedule, as well as deductibles and savings options for renters insurance. State Farm offers straightforward assistance and impressive coverage for your mementos, swing sets and clothing in your rented apartment. When the unexpected happens, State Farm can help.

Renters of Bedford, State Farm can cover you

Renting a home? Insure what you own.

Agent Michael Meehan, At Your Service

You may be unconvinced that Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the home. What would happen if you had to replace your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when fires or break-ins occur.

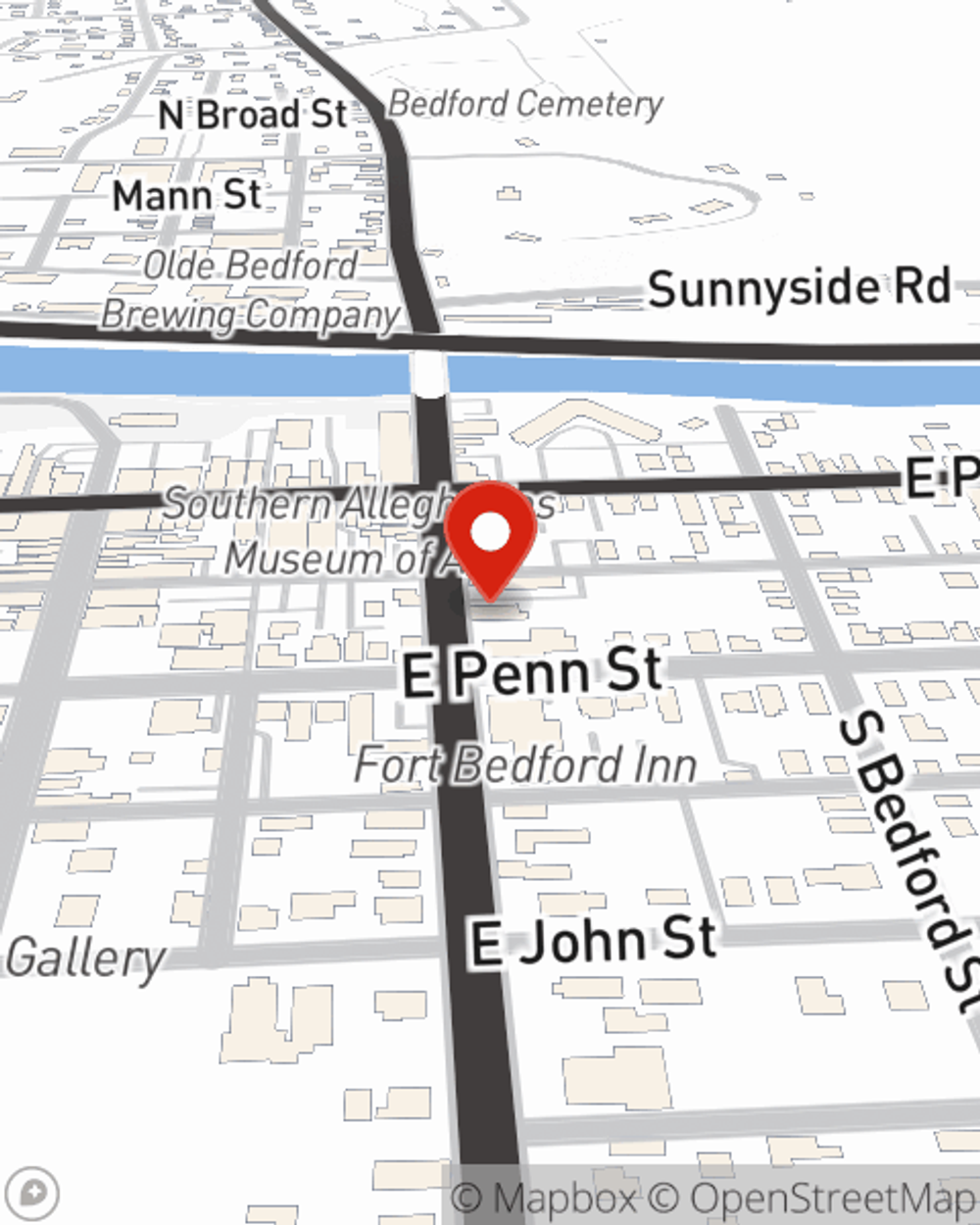

State Farm is a reliable provider of renters insurance in your neighborhood, Bedford. Reach out to agent Michael Meehan today for help understanding your options!

Have More Questions About Renters Insurance?

Call Michael at (814) 623-8165 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Michael Meehan

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.